Advanced Nuclear in Review: Halftime 2024

By: Justin Lindemann, Policy Analyst

2024 is halfway over, and much has already happened within the advanced nuclear industry in the U.S. From state legislatures to Congressional actions, the advanced market is seeing immense interest and preparations for the next decade.

State Legislation and Industry Updates

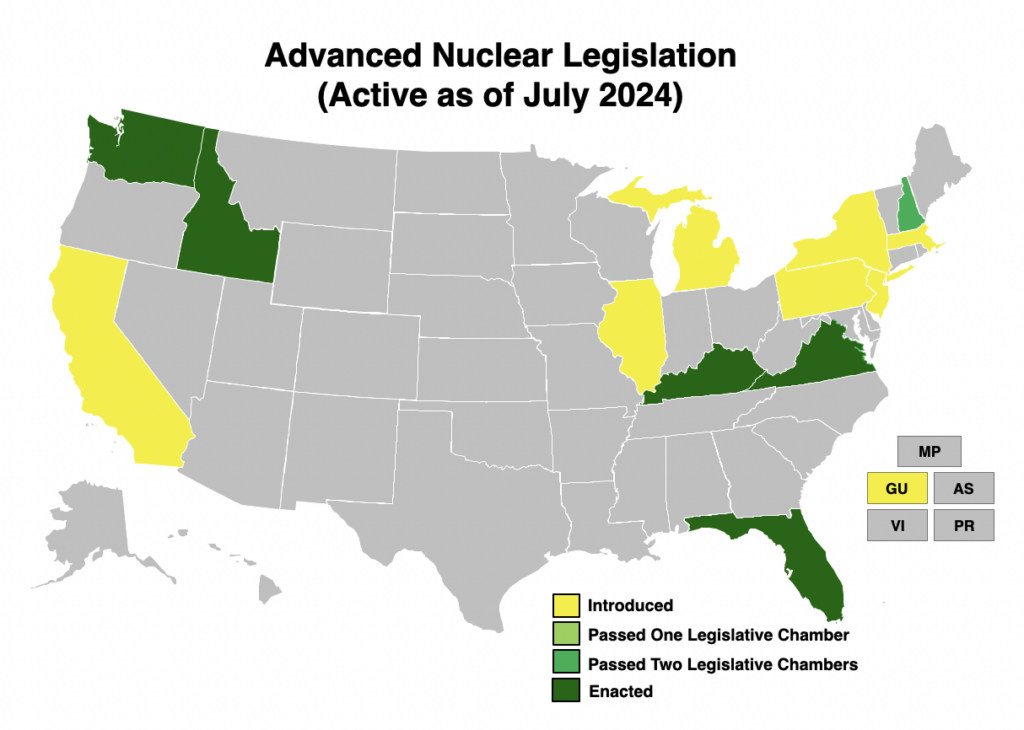

As of July 2024, an estimated 22 bills/resolutions are still active, and 8 bills/resolutions have been enacted/approved by state lawmakers this year. Notable highlights from the first half of 2024 include:

- Governor Jay Inslee of Washington signed the bill into law in late March 2024; as a result, the state must ensure that its pursuit of clean energy includes fusion and create a fusion energy working group to identify new and existing permitting, siting, licensing, and registration pathways for procurement.

- Governor Andy Beshear of Kentucky signed a bill in early April 2024 directing utility regulators to make staffing, organizational, and administrative preparations for the potential sitting and construction of nuclear energy facilities in the state, such as SMRs. Another piece of legislation signed also established a state authority to serve as a non-regulatory agency on nuclear energy development after the legislature overrode the Governor’s veto. The authority will assist interested communities in understanding advanced nuclear opportunities and must submit a site suitability study by December 1, 2025, to identify new reactor locations in the state. Kentucky’s state utility regulators have been directed to prepare for the potential cost and construction of SMRs, including providing training for existing staff on related siting and construction issues, among other things.

- Idaho’s state legislature adopted a resolution in late March 2024, declaring the state’s support for advanced energy research, including improving the safety, licensing, and regulation processes for developing advanced nuclear reactors.

- Governor Ron DeSantis signed a bill in mid-May 2024, requiring state utility regulators to report their findings and recommendations by the end of Q1 2025 for potential legislation/actions that could enhance advanced nuclear technology usage, like SMRs, including the economic and technical feasibility of SMRs. Public utilities are also directed to petition regulators to approve retiring a plant with at least 75 MW capacity.

- In mid-April 2024, Virginia enacted various bills that amended certain utilities’ ability to recover the cost of SMR development, encompassing any preliminary analysis, testing, and site evaluation of the utility-owned property, including purchasing property or siting. A utility can only recover an amount that would not increase the typical residential customer’s bill by more than $1.40/month. Project costs can be recovered up to one SMR facility (one or multiple SMRs at a single site), and a rate adjustment clause associated with such a project cannot be implemented before 2026.

- New Hampshire legislators passed a bill requiring the state’s Department of Energy to continue studying nuclear energy development, including advanced nuclear technologies.

As for industrial developments, in late March 2024, TerraPower announced that it submitted a construction permit to the U.S. Nuclear Regulatory Commission (NRC) for its 345 MWe Natrium small modular reactor (SMR) demonstration project in Kemmerer, Wyoming. TerraPower is the first to submit its construction permit application for a commercial advanced reactor to the NRC, which accepted TerraPower’s application and is currently reviewing it. On June 10, 2024, TerraPower began construction on its Natrium reactor in Wyoming. The company is going through with nonnuclear construction work as it is going through the NRC certification process.

Besides SMRs (nuclear reactors with an average capacity range of 20 to 300 MW), microreactors (those with a capacity of up to 20 MW) also have had a moment in 2024. In early April 2024, Santa Clara-based advanced nuclear technology company Oklo announced that it has signed a pre-agreement with Equinix, the largest global data center and colocation provider for network and cloud computing, for up to 500 MW of procured nuclear energy. Equinix made a $25 million prepayment to Oklo for a supply of nuclear energy, giving them the option of Oklo stock or discounted power supply. Equinix instead chose to purchase power to serve its data centers on a 20-year timeline and has the right to renew for an additional 20 years. The microreactor deal is the first signed by a colocation data center company. Oklo announced a partnership with Wyoming Hyperscale more than a month later through a non-binding letter of intent for collaboration under a 20-year PPA. Wyoming Hyperscale wants to use Oklo’s microreactor design to power a state-of-the-art data center campus using 100 MW of nuclear energy. Oklo is one of two newly debuted publicly traded companies to enter the market, in addition to NANO Nuclear Energy, which does research and development of its ZEUS and ODIN microreactor designs and its HALEU activities, advancing licensed technology to transport commercial amounts of HALEU, development of US domestic source of advanced fuel fabrication for its microreactors and the industry at-large, among other things.

In terms of utility development, Duke Energy Florida’s Integrated Resource Planning managing director testified as part of the company’s 2024 multi-year rate case that it is considering developing next-generation nuclear, including SMRs, on company-owned land in Gainesville, among other zero-emission resources. Georgia Power’s fourth Vogtle nuclear reactor unit started commercial operation in late April 2024. In the Midwest, in early May 2024, executives at Constellation Energy stated it is considering building next-generation nuclear plants on existing sites to meet demand from data centers, including using SMRs to deliver electricity to large-load customers. In a quarterly earnings call held during the week of May 6, 2024, the CEO of Constellation Energy did not entirely rule out recommissioning Pennsylvania’s Three Mile Island Unit 1, which was closed in September 2019. The question of recommissioning was posed to the CEO in response to the news of Michigan’s Palisades nuclear power plant recommissioning.

Federal Legislation and Agency Actions

Federally, President Biden signed the 2024 Consolidated Appropriations Act in early March 2024, which appropriates unobligated spending from the Infrastructure and Investment Jobs Act (otherwise known as the Bipartisan Infrastructure Law) for commercial utility deployment of a grid-scale Gen. 3+ SMR design and to support design, licensing, supplier development, and site preparation under the Advanced SMR Research, Development, and Demonstration Program. An additional $2.72 billion in unobligated funds has been appropriated for use by existing federal programs to strengthen and develop domestic supply chains for low-enriched uranium and advanced nuclear fuels.

The President also signed into law a bill that, among many other things, extends the Price-Anderson Act to the end of 2065 and quadruples the federally subsidized liability coverage for nuclear incidents that occur outside the United States, increasing it from $500 million to $2 billion. The definition of what constitutes a nuclear incident outside the country was also amended, removing the inclusion of an incident that occurs because of source, special nuclear, or byproduct material owned, used, or under contract with the U.S. In addition to signing a bill that bans those in the U.S. from importing low-enriched Russian uranium, it also allowed for a transitional period in which stakeholders can access waivers until 2028.

President Biden also signed a bill earlier this month focused on fire prevention and safety, which includes historic advanced nuclear provisions via the ADVANCE Act of 2024, including provisions on American nuclear leadership, preserving existing nuclear energy generation, provisions on fuel supply and infrastructure, improving the efficiency of the NRC, among others. The following provisions are just some of the most significant parts of the law:

- The U.S. Secretary of Energy is authorized to award eligible entities (i.e., TVA and a non-Federal entity) to which the NRC has issued an operating or combined license. The award is equal to the total amount assessed by the NRC related to costs from license issuance, construction permit issuance, or an early site permit. The award categories vary and will be given to the first advanced nuclear reactor that is issued a license; a reactor that uses isotopes derived from spent fuel or depleted uranium as advanced nuclear fuel, and is the first advanced nuclear reactor of such kind to be licensed; a reactor that is a nuclear-integrated energy system (composed of two or more co-located energy storage, generation, or other tech, among other specifications) to which the NRC issues a license; a reactor that flexibly generates electricity or high temperature process heat for nonelectric use cases, and has also been issued a license; as well as the first reactor for which the NRC grants approval to under the technology-inclusive regulatory framework authorized by the NRC. It is important to note that references to advanced reactor applications do not include potential licenses for fusion reactors, as they have separate application processes.

- The NRC must evaluate any modifications to current regulations that would support the establishment of nuclear facilities at brownfield sites and must develop and implement strategies to enable timely licensing reviews for nuclear fuel production facilities or fuel utilization facilities (e.g., reactors) at brownfield sites, which must include retired fossil fuel sites.

- The NRC must develop risk-informed, performance-based strategies and guidance for licensing and regulating microreactors, including for the transportation of fueled reactors.

- The NRC must submit a study no later than one year after this bill’s enactment, conducted with the Agreement States (states that have entered into agreements with the NRC giving them the authority to license and inspect byproduct, source, or special nuclear materials used or possessed within their borders) and the private fusion sector, on risk- and performance-based, design-specific licensing frameworks for mass-manufactured fusion machines.

- The NRC has the authority to establish within the Office of International Programs the “International Nuclear Reactor Export and Innovation Branch” to carry out appropriate international nuclear reactor export and innovation activities. Enriched uranium from Russia or China is also disallowed in the U.S. unless the NRC issues a permit after consulting with the Secretaries of Energy and State.

- The NRC must submit a report on manufacturing and construction for nuclear energy applications, including advanced processes and techniques; and the establishment of a Nuclear Energy Traineeship Subprogram, under which the NRC and higher education and trade school institutions will competitively award traineeships related to nuclear.

Congress is also reviewing the Atomic Energy Advancement Act, which passed the House in late February 2024. If enacted, the bill would be a game-changer for nuclear development in the U.S. and would enact a plethora of provisions, including the following:

- Requires the NRC to establish an optional technology-inclusive regulatory framework by 2028 for fusion development; and directs the NRC to develop and implement licensing and regulation microreactor strategies and guidance.

- Establishes a federal incentive program for first-of-a-kind advanced nuclear reactors to speed up the development of commercial advanced nuclear, with the incentive covering up to the total cost of licensing a project.

- Mandates lower regulatory costs for advanced nuclear reactor application reviews

- Establishes a long-term nuclear power purchase agreement (PPA) pilot program, under which the U.S. Secretary of Energy must enter into at least one long-term PPA (10 to 40 years) by 2029 for power generated by a commercial nuclear reactor that was given an operating license after January 1, 2024.

In other federal developments, in late March 2024, the U.S. Department of Energy’s Loan Programs Office (LPO) announced a conditional commitment to provide up to $1.52 billion to Holtec Palisades in Michigan for a loan guarantee to finance the restoration and service resumption of the 800 MW Palisades nuclear power plant. If Holtec Palisades does resume operations, it will be the first recommissioning of a shut-down commercial nuclear power plant in the country’s history.

2024: Looking Ahead

To review, 2024 is halfway over and already off to a booming start for the advanced nuclear industry as more states are showing an interest in Gen IV nuclear technology. Additionally, first-of-its-kind projects are already making significant advancements through the proper regulatory channels. Plus, with the idea of recommissioning older projects becoming a serious reality, what is dead may one day see life, shifting the civilian nuclear fleet into a drastically new paradigm.

On another note, while Congress took somewhat of a backseat last year, as states showed strong support for advanced nuclear, state and federal legislators are firing on all cylinders this year. While significant headway has already been made federally, 2024 may be the “Year of Nuclear” as Congress has the potential to enact another historic piece of clean energy legislation since 2021’s Inflation Reduction Act, the Atomic Energy Advancement Act. Overall, the continuation of 2023’s historic progress sure looks to be followed with even more developments this year as the market tries to move into more commercialized territory.

Read about last year’s record-breaking year for advanced nuclear in the United States, and check out DSIRE Insight’s Jan. 2024 blog post: “2023 in Review: Navigating the Advanced Nuclear Landscape.”